Weekly Market Commentary 10-25-2021

Weekly Market Commentary

October 25, 2021

The Markets

It’s MESSI!

No, this commentary is not about Lionel Messi, the Argentine soccer phenom who is widely regarded one of the greatest footballers of all time. However, it is about something that economists say may be as rare as Messi’s talent: Moderating Expansion with Sticky Supply-driven Inflation (MESSI).

You can see why we prefer the acronym.

MESSI is a type of inflation that occurs when “strong, but cooling demand is met by constrained, but accelerating supply, leading to transitory, yet sticky inflation.”1 The coronavirus pandemic may have produced just the right circumstances, according to Gregory Daco of Oxford Economics.

“Initially, extreme health conditions, severe social distancing measures, and unprecedented fiscal transfers to households supported a surge in spending on goods. With domestic and international supply struggling to rebound quickly and inventories being run down, prices for goods surged. Later, as the health situation improved, the re-opening of the economy led to greater demand for services which also ran into the tight supply conditions, leading to higher service sector inflation.”

The recent rapid rise of inflation has many people concerned that we may experience runaway inflation, which occurs when prices rise rapidly, or stagflation, which occurs when economic growth slows while inflation rises. Daco doesn’t believe either will prove to be the case:

“It’s not runaway inflation, and it’s certainly not stagflation…In the debate between transitory and runaway inflation, we have repeatedly said that the truth lies somewhere in the middle, with inflation likely to be ‘sticky but not oppressive.’”

The baseline view from Oxford Economics is that higher inflation will persist into the first half of 2022 before falling back to about two percent by the end of next year.

Time will tell.

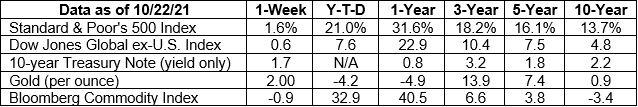

Last week, the Dow Jones Industrial Average closed at a record high, and the Standard & Poor’s 500 Index and Nasdaq Composite also finished higher, according to Ben Levisohn of Barron’s. The yield on 10-year U.S. Treasuries also moved higher.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; Federal Reserve Bank of St. Louis; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

What do you know about bonds?

The bull market in bonds has persisted for 40 years. In September 1981, the interest rate on 10-year U.S. Treasury bonds was 15.8 percent. In 2020, the interest rate bottomed at 0.52 percent and has moved higher. Whether the bull market ends or continues, it’s important for investors to know bond basics. Test your knowledge of bonds by taking this brief quiz.

- In general, a bond is:

- A loan that an investor makes to a company, a government, or another organization

- An investment that pays a specific amount of interest over a set period of time

- An investment that is expected to return an investor’s principal at maturity

- All of the above

- If interest rates rise, what will typically happen to bond prices?

- Prices rise

- Prices fall

- Prices remain stable

- There is no relationship between interest rates and bond prices.

- Bonds are called many different names. Which of the following is not an alternative name for bonds?

- Fixed income

- Notes

- Equities

- Debt securities

- The interest rate on floating-rate notes adjusts as rates change. When might it be advantageous to have these bond investments in a portfolio?

- When interest rates fall

- When interest rates rise

- Anytime

- Never

If you have any questions about the quiz or about bonds and the role they play in your portfolio, give us a call.

Weekly Focus – Think About It

“Don't think money does everything or you are going to end up doing everything for money.” — Voltaire, philosopher

Answers: 1) d; 2) b; 3) c: 4) b

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://resources.oxfordeconomics.com/hubfs/It_aint_stagflation_but_it_sure_is_MESSI.pdf (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/10-25-21_Oxford%20Economics%20Research%20Briefing_1.pdf)

https://www.barrons.com/articles/dow-record-high-big-tech-earnings-51634948547?refsec=the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/10-25-21_Barrons_How%20the%20Dow%20Ignored%20Big%20Risks%20on%20its%20Way%20to%20a%20Record%20High_4.pdf)

https://fred.stlouisfed.org/series/DGS10#0

https://www.finra.org/investors/learn-to-invest/types-investments/bonds/bonds-basics