Weekly Market Commentary 05-10-2021

Weekly Market Commentary

May 10, 2021

The Markets

Like a gender reveal gone wrong, last week’s employment report delivered an unexpected surprise.

Economists estimated 975,000 new jobs would be created in April. The United States Bureau of Labor Statistics (BLS) reported there were just 266,000. That’s a big miss.

Economists, analysts, and the media offered a wealth of theories to explain the shortfall. These included:

- Pandemic fear. A March U.S. Census survey found 4.2 million people aren’t working because they fear getting or spreading the coronavirus, reported Gwynn Guilford of The Wall Street Journal. That’s more than half of the 8.2 million non-farm jobs that need to be recovered to reach pre-pandemic employment levels.

- Too-generous unemployment benefits. Another theory is federal unemployment benefits ($300 a week) have created a labor shortage. The theory is being tested. Last week, Montana announced it will no longer participate in federal unemployment programs. Instead, it will offer a $1,200 return-to-work bonus, reported Greg Iacurci of CNBC.

- Low pay. Some say Americans are less willing to work for low pay than they were before the pandemic. Christopher Rugaber of the AP interviewed a Texas staffing office manager who reported job seekers are turning down jobs that pay less than unemployment benefits.

A former retail worker told Heather Long of The Washington Post, “The problem is we are not making enough money to make it worth it to go back to these jobs that are difficult and dirty and usually thankless. You’re getting yelled at and disrespected all day.”

- Lack of childcare. Many women who want to work left jobs during the pandemic to care for children. The April employment report showed a slight decrease in the rate of unemployment for adult women; however, it resulted from women giving up on job searches rather than finding work. The Institute for Women’s Policy Research reported, “…more women continued to exit rather than enter the workforce: 165,000 fewer women had jobs or were actively looking for work in April than in March.”

- Quirky data. Statistical distortions or seasonal factors could be responsible. “The more time the market has to digest [the] report, the more the report seems a bit of an anomaly relative to other data,” said a deputy chief investment officer cited by Mamta Badkar and Naomi Rovnick of Financial Times.

Other data include the ADP® National Employment Report™ which showed 742,000 new jobs in April. The report reflects real-time data on one-fifth of U.S. private payroll employment.

- Rethinking work. “There is also growing evidence – both anecdotal and in surveys – that a lot of people want to do something different with their lives than they did before the pandemic. The coronavirus outbreak has had a dramatic psychological effect on workers, and people are reassessing what they want to do and how they want to work, whether in an office, at home, or some hybrid combination,” reported The Washington Post.

U.S. financial markets shrugged off the news. The Standard & Poor’s 500 Index finished the week at a record high, and 10-year Treasury rates finished Friday where they started.

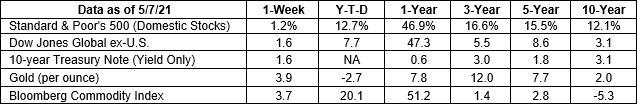

(The one-year numbers in the scorecard below remain noteworthy. They reflect the strong recovery of U.S. stocks from last year’s coronavirus downturn to the present day.)

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; Federal Reserve Bank of St. Louis; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Check out the big brain on Brett!

There is a long-standing scientific theory about the size of a mammal’s body relative to its brain that offers an indication of intelligence. The findings of a recent study seem to debunk that idea, reported Science Daily.

An international team of scientists investigated how the brain and body sizes of 1,400 living and extinct mammals evolved over time. They made several discoveries. One was significant changes in brain size that happened after two cataclysmic events in Earth's history: a mass extinction and a climatic transition.

Not every mammal changed in the same ways. Elephants increased body and brain size. Dolphins and humans decreased body size and increased brain size. California sea lions increased body size without comparable increases in brain size. All have high intelligence.

“We've overturned a long-standing dogma that relative brain size can be equivocated with intelligence…Sometimes, relatively big brains can be the end result of a gradual decrease in body size to suit a new habitat or way of moving – in other words, nothing to do with intelligence at all. Using relative brain size as a proxy for cognitive capacity must be set against an animal's evolutionary history,” stated Kamran Safi, a research scientist at the Max Planck Institute of Animal Behavior and one of the study’s authors.

Of course, intelligence doesn’t always translate into wise behavior.

Studies of behavioral finance have found the human brain is more interested in survival than saving. “It turns out that, when it comes to money matters, we are wired to do it all wrong. Our brains have evolved over thousands of years to focus on short-term survival in a dangerous world with limited resources. They were not designed for today’s optimal financial behaviors,” wrote financial psychologist Dr. Brad Klontz, a CNBC contributor.

No one knows how the COVID-19 pandemic will be remembered over time, but it appears to have influenced the way people think about money in some significant ways. An April 2021 Bank of America survey reported:

- 81 percent of participants saved money, that would normally be spent on entertainment, dining, and travel, and set it aside in emergency, savings, and other types of accounts.

- 46 percent used pandemic downtime to put their finances in order.

- 44 percent said their risk tolerance changed: 23 percent became more aggressive and 21 percent more cautious.

If the pandemic has changed your thinking, let’s review your financial plan and align it with your current circumstances and thinking.

Weekly Focus – Think About It

“It doesn't matter how beautiful your theory is, it doesn't matter how smart you are. If it doesn't agree with the experiment, it's wrong.” --Richard P. Feynman, Theoretical physicist

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.wsj.com/articles/the-other-reason-the-labor-force-is-shrunken-fear-of-covid-19-11618163017 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-10-21_WSJ-The_Other_Reason_the_Labor_Force_is_Shrunken-Fear_of_COVID-19-Footnote_2.pdf)

https://www.cnbc.com/2021/05/05/montana-opts-to-end-300-unemployment-boost-other-states-may-too.html

https://www.washingtonpost.com/business/2021/05/07/jobs-report-labor-shortage-analysis/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-10-21_TheWashingPost-Its_Not_a_Labor_Shortage-Its_a_Great_Reassessment_of_Work_in_America-Footnote_5.pdf)

https://www.ft.com/content/9ef97745-c4d7-4273-b1f1-07d5d55efbc8 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-10-21_FinancialTimes-S_and_P_500_Ends_at_Record_Despite_Disappointing_Jobs_Report-Footnote_7.pdf)

https://adpemploymentreport.com/2021/April/NER/NER-April-2021.aspx

https://www.barrons.com/articles/why-the-stock-market-rose-this-past-week-what-to-know-51620430506?mod=hp_LEAD_3 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-10-21_Barrons-The_Dow_Surged_to_a_Record_High_Because_the_Bad_News_Wasnt_So_Bad-Footnote_9.pdf)

https://www.sciencedaily.com/releases/2021/04/210429090227.htm

https://www.mpg.de/16785076/disaster-brain-size?c=2249

https://www.cnbc.com/2019/12/09/when-it-comes-to-money-our-brains-are-wired-to-do-it-all-wrong.html